We have been trying hard at our house to stash away a little money. Here are two different ways we have been saving:

1. An Emergency Fund

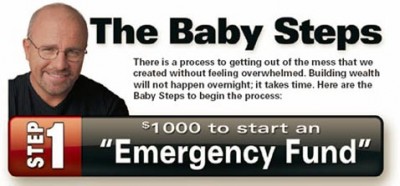

Chad and I were so proud of ourselves this month. We were meeting some financial goals, one of which was to build our emergency fund up to Dave Ramsey’s suggested initial amount of $1000.

Now an emergency fund is different than our long-term savings, short-term savings, retirement, college funds, etc. It is a fund set up just for emergencies. The money is in its very own savings account and is not to be confused with Christmas or travel or insurance accounts.

One Sunday night, as we sat down to review our budget, we added the last $200 to the emergency account. With the emergency budget complete, I was happy to check off another financial goal.

Then Monday came and I got out of the car after taking Elle to piano and heard a whizzing sound. My back tire was going flat at a rapid speed. Within minutes the tire was all the way flat. Chad came home from work and put on the spare tire so we could drive the car to the tire shop the next morning. They found a 3 inch piece of metal stuck in the tire.

At first they just repaired the tire, but by the next day the tire was going flat again. We realized we were going to need a completely new tire which meant we were actually going to need two new tires so the car could stay balanced. The tires had to be ordered in so we were without a car for a couple of days. Saturday morning the new tires were put on and we were on our way (to Crew’s baptism).

Bye Bye $450.

The next day was Sunday and we had to go to a baby blessing about 20 minutes away. We came out early in the morning and our car wouldn’t start. We figured someone left a door ajar or something so we jumped the car and drove to church. As we got out of the car, Chad went to lock it, but the car was dead again. After church we tried jumping it a few more times, but nothing. The battery was gone beyond repair. So Chad and I had to go buy a new battery and then change the old one out all on a Sunday morning.

Bye Bye $150.

Bye Bye emergency fund.

But I guess that is what emergency funds are for, right? They are for unexpected events that come up. This way you have the money stashed away and don’t have to put these expenses on a credit card when they occur. Having an emergency savings fund takes a little bit of stress off these otherwise stressful situations. I guess we go back to building ours up again.

2. Money Goal Jars

We want our kids to learn to save too so my kids all have a jar where they get to keep their short term savings. These jars are not their college or mission funds but rather a place where they save for short-term WANTS like a bike or an iPod or a play ticket or a basketball camp. Or in Crew’s case: a Wii Sports Resort game.

I got the jars at Hobby Lobby. I bought large ones so they could hold lots of money and I liked the ones with the clamp so the money felt a little protected. Then I put a chalkboard sticker on the front of the jar, so the kids can change their goals as they meet them and move on (or when they decide that it will just take too long to save up for an iPod:)

Elle used her jar successfully to buy a new bike.

She saved for several months and then finally purchased this little cutie.

The short-term savings jars have worked well for my older kids, so I thought maybe they would work for me too.

I just started working part time for my husband. He needed some extra help with his business and I wanted more money. The money that I earn gets to go towards fun stuff for me which translated means home improvement and home decor. So I decided to take over Locke’s jar since he doesn’t get the concept of money yet.

My first goal is a new bed for Croft. The poor girl is sleeping on a mattress right now.

(You can see there is nothing in there right now because I gotta build up that dang emergency fund again.)

I hope that as my children see me save and wait to buy until I have enough cash that they will develop those same saving habits as well.

Happy Saving!

![I spoke in church today and said the Atonement of Jesus Christ is the greatest act of Charity. I read Moroni 7:45-47 to make my point. But wherever there was the word ‘Charity’ I substituted it out for ‘the Atonement of Jesus Christ.’ See if these scripture verses now have new meaning for you:

“And the Atonement of Jesus Christ suffererth long, and is kind, and envieth not, and is not puffed up, seeketh not her own, is not easily provoked, thinketh no evil, and rejoiceth in the truth,

[The Atonement of Jesus Christ] beareth all things, believeth all things, hopeth all things, endureth all things.

Wherefore, my beloved brethren, if ye have not the Atonement of Jesus Christ, ye are nothing, for the Atonement of Jesus Christ never faileth. Wherefore, cleave unto the Atonement of Jesus Christ, which is the greatest of all, for all things must fail-

But the Atonement of Jesus Christ is the pure love of Christ, and it endureth forever; and whoso is found possessed of it at the last day, it shall be well with him.”

So Easter really reminds us of love. The first and greatest commandment.](https://www.raisinglemons.com/wp-content/plugins/instagram-feed-pro/img/placeholder.png)

Great way to teach kids and yourself too. Love Dave Ramsey. Love the jars.

Where did you get the bike? What is the brand?